Trading Dominion – Portfolio Investing | Size: 5.87 GB

Portfolio investing

Get steady and consistent returns with low drawdowns, spending just 20 mins per month

The main aim of this course is to explain all of those technical financial terms in a way that is simple and easy to understand.

Many of the concepts are explained visually, and we focus on understanding the core idea without getting deep into the weeds.

We focus on things that are practical, and are later applied onto the analysis of real portfolios.

We will build some spreadsheets together, step by step, in order to make sure that the concepts and calculations are fully understood and internalized.

We’ll make use of some extremely powerful and functional online tools that can automate much of the portfolio analysis, and all without needing to write a single line of code.

In the course we’ll cover around a dozen or so pre-made portfolios that you can start off with. Additional portfolios and trading strategy ideas will be added over time, as our community continues to grow and share ideas.

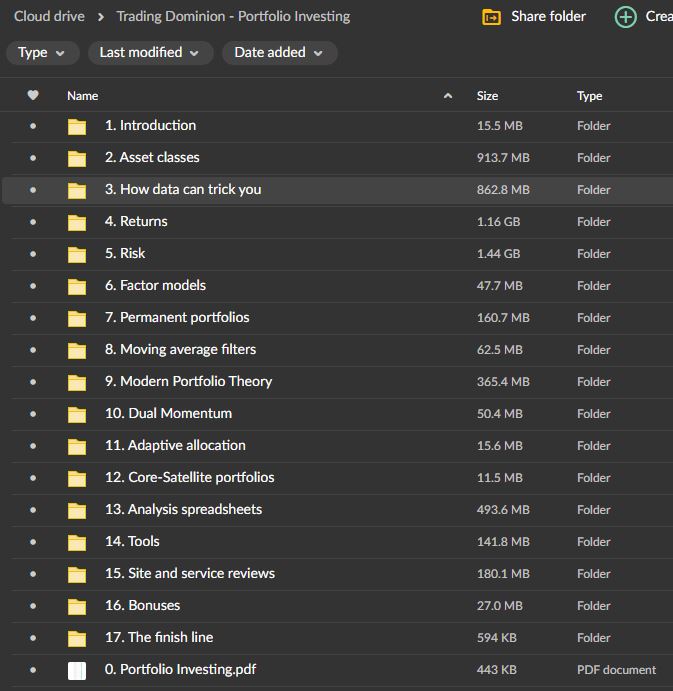

Course contents

Introduction

- Welcome to the course

- Strategic versus tactical asset allocation

- Introduction to bonds

- Asset classes

- Hedge funds

- How data can trick you

Returns

- Getting historical data

- Linear versus log scale

- Arithmetic and log price returns

- Cumulative arithmetic and log price returns

- Converting arithmetic and log returns

- Arithmetic and geometric mean

- Wealth index

- Performance charts

Measuring risk

- Variance and standard deviation

- The portfolio effect

- Sharpe ratio, Sortino ratio, Calmar Ratio, Martin Ratio

- Alpha and Beta

- Correlation and R Squared

- Treynor Ratio and Information Ratio

- Value-At-Risk and Expected Shortfall

Factor models

- Capital Asset Pricing Model (CAPM)

- Fama French 3 factor model

Permanent portfolios

- Equal and Value Weighting portfolios

- Calculating portfolio returns

- Review of 5 different permanent portfolios

Moving average filters

- M.A.F. – single asset

- M.A.F. – all assets in a portfolio

Modern Portfolio Theory

- Introduction to MPT

- Correlation and the correlation matrix

- Efficient frontier

- Minimum variance portfolio and mean-variance efficient portfolios

- Rebalancing

- Return vs risk graph

- Capital Allocation Line, and margin effect on returns

- Kelly Criterion – optimal f

- Inverse variance portfolio

- Risk parity portfolio

Dual Momentum

- Review of 6 different dual momentum portfolios

Other portfolios

- Review of two Adaptive Allocation portfolios

- Review of two Core-Satellite portfolios

Sales Page: Link

Join us on Telegram: https://t.me/thecoursepedia

More courses: https://thecoursepedia.com/shop/

Reviews

There are no reviews yet.