The Strategy Lab (WRB Analysis) Price Action Trading (Manuals only) Download

The Strategy Lab (WRB Analysis) Price Action Trading (Manuals only) | Size: 12.9 MB

WRB Analysis is a method that involves the combination of analyzing changes in volatility and supply/demand. Simply, WRB helps traders to understand and exploit changes in volatility as a way to identify key price areas where there’s an important change in supply/demand prior to the appearance of any trade signals.

WRB Analysis can be applied to time based candlestick or bar charts, volume based charts or tick based charts although the chart examples at this website are via time based candlestick charts.

Also, WRB Analysis identifies changes in supply/demand that’s occurring between buyers and sellers along with providing a map for exploiting the price action from swing point to swing point regardless if your a day trader, swing trader or position trader.

The word WRB means Wide Range Body (candlestick chart users) or Wide Range Bar (bar chart users) and there are different types of WRBs based upon volatility analysis, gap analysis or support/resistance analysis. Yet, be aware that you can use Bar charts for WRB Analysis but you must be using Wide Range Body Analysis and not Wide Range Bar Analysis.

The wide range is an interval that has a body (difference between Open and Close) or bar (difference between high and low) with a price area larger than each of the prior three intervals. In fact, you can use any number greater than three intervals as long as it’s not less than three due to the behavior of volatility analysis because its less reliable and too difficult to analyze the volatility of two intervals or less regardless if the intervals are based upon time, volume or tick. Simply, you want as much market context as possible from the price action to help ensure proper analysis of changes in volatility and supply/demand.

Yet, there will often be a different number of WRBs, WRB Hidden Gaps and WRB Zones depending upon what aspect of the expansion interval is being used as a measurement. However, even though you may see the word body used more often than the word bar in my discussions of WRB Analysis at TheStrategyLab.com or charts posted elsewhere online, it does not imply that candlestick charts should be used instead of bar charts…it’s only because I have a personal preference in using candlestick charts even though WRB Analysis has nothing to do with Japanese Candlestick Analysis.

In fact, about 25% of our clients use bar charts instead of candlestick charts while using WRB Analysis in their trading.

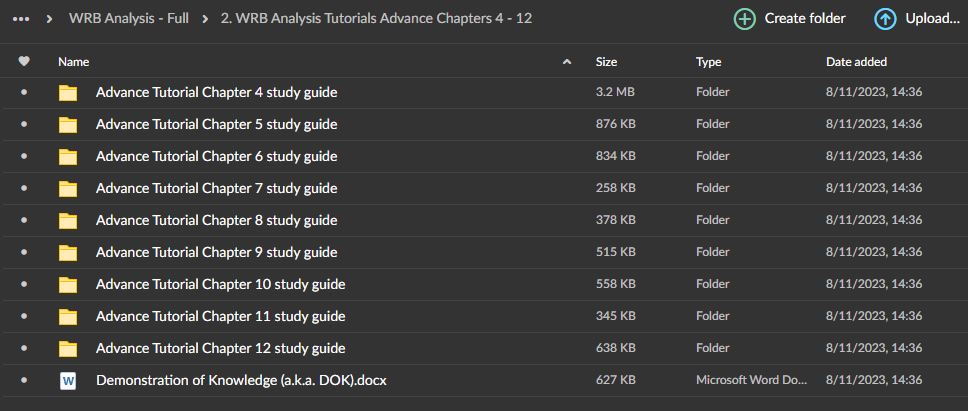

Total 12 Chapters On Price Action Trading

Many Concepts ICT copied from TheStrategyLab

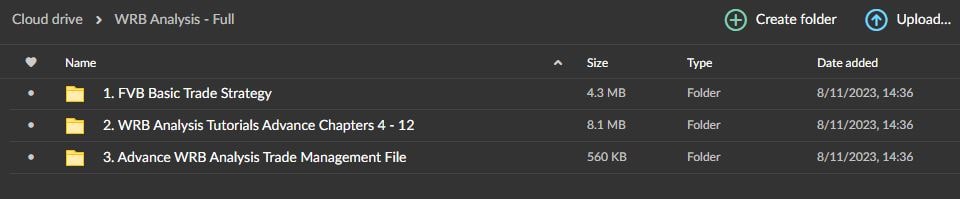

The Strategy Lab (WRB Analysis) Price Action Trading (Manuals only) Download

- Files will be delivered through MEGA Download Link

- 100% Safe & Secure Payments

Join us on Telegram: https://t.me/thecoursepedia

More courses: https://thecoursepedia.com/shop/

Reviews

There are no reviews yet.